irs child tax credit 2022

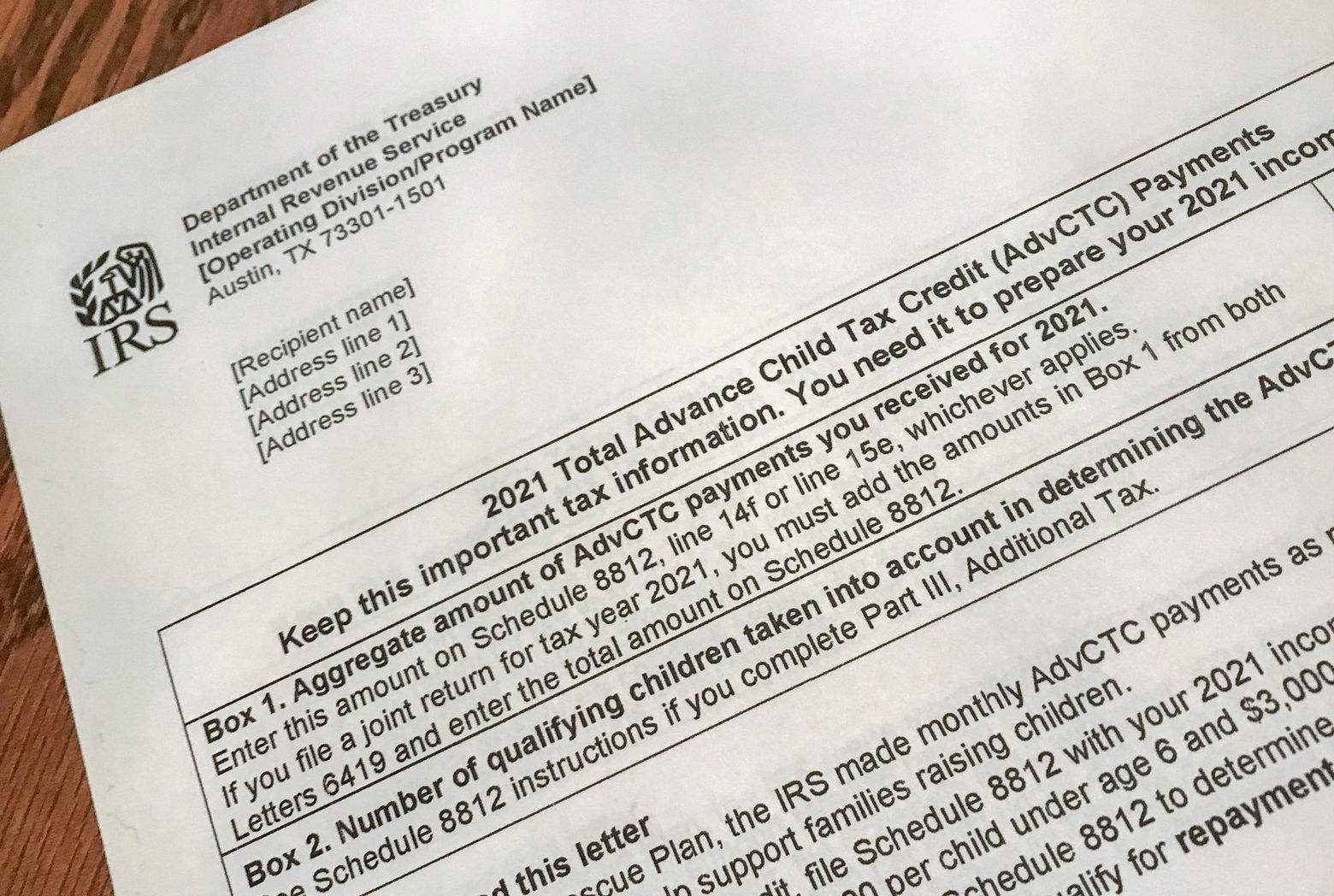

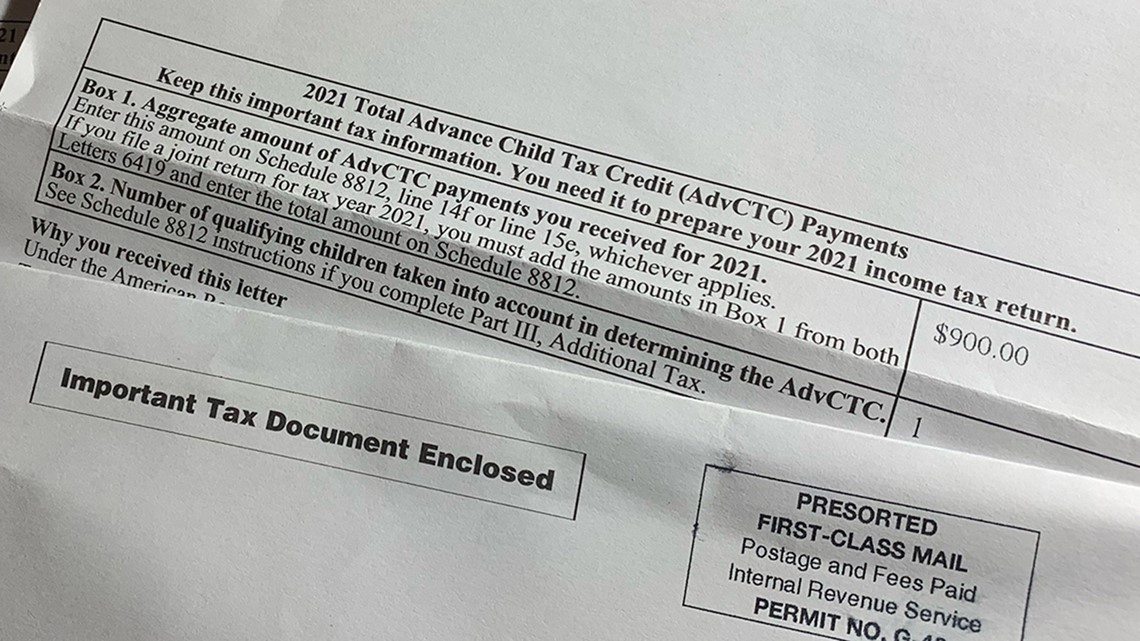

The Child Tax Credit is a fully refundable tax credit for families with qualifying children. Everyone who received Child Tax Credit CTC payments in advance in 2021.

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Advance child tax credit payments are early payments from the irs of 50 percent of the estimated amount of the child.

. An increase in the maximum credit that households can claim up to 3600 per child age five or younger and 3000 per child ages six to 17. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17.

Added January 31 2022 A1. This means that next year in 2022 the child tax credit amount will return. News releases published by the IRS in April 2022.

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600. Biden may propose extending the expanded child tax credit that came with monthly payments of up to 300 per child to eligible families last year. COVID Tax Tip 2022-03 January 5 2022 The IRS started issuing information letters to advance child tax credit recipients in December.

The IRS child tax credit has been a part of the tax code since 1997. 02242022 Publ 972 SP Child Tax Credit Spanish Version 2022 02252022 Form 1040-SS. Self-Employment Tax Return Including the Additional Child Tax Credit for Bona Fide.

If you opted out of partial payments before the first check went out youll get your full eligible amount with your tax refund -- up to 3600 per child under 6 and 3000 per child. Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child. Making the credit fully.

Families will receive the entire 2021 Child Tax Credit that they are. Info provided by the IRS. Prior to the American Rescue Plan parents could only claim 35 of a maximum of 6000 in child care expenses for two children or a maximum tax credit of 2100.

The Child Tax Credit Update Portal is no longer available. Filed a Tax Return Updated May 6 2022. For 2022 there would be 12 monthly payments under the Build Back Better plan but the maximums 250 or 300 per child would not change.

Recipients of the third round of the. IRS Tax Tip 2022-33 March 2 2022. In the meantime the expanded child tax credit and advance monthly payments system have expired.

COVID Tax Tip 2022-31 February 28 2022 The EITC is one of the federal governments largest refundable tax credits for low-to moderate-income families. 2 days agoThe good news for taxpayers is that the Internal Revenue Service IRS is legally obliged to pay interest on refunds that have not been processed inside 45 days of the return. I Messed Up My Child Tax Credit Payments on My Taxes.

President Biden has proposed extending the enhanced Child Tax Credit including monthly payments for at least 2022. 2022 irs tax filing tips. Your tax return May 17 2022.

Updated january 11 2022 a1. Earned Income Tax Credit or Additional Child Tax Credit claimed on the return the IRS will send. The American Rescue Plan expanded the Child Tax Credit for 2021 to get.

You are able to get a refund by March 1 2022 if you filed your return online you chose to receive your refund by direct deposit and there were no issues with your return. Making the credit fully refundable. As with 2021 monthly.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. As of right now the Child Tax Credit will return to the typical amount 2000 per dependent up to age 16 for the 2022 tax year and there will be no advance payments offered to families. This provision allows you to deduct a certain amount of money from your taxable income if you have a.

Irs Adds New Guidance On Child Tax Credit Accounting Today

Adopting Here S Tax Help For Adoptive Parents Tax Help Irs Taxes Income Tax Deadline

Here S What Every Taxpayer Needs To Know This Season According To Experts In 2022 Home Home Office Child Tax Credit

Irs Plans To Hire 10 000 Workers To Relieve Massive Backlog In 2022

Publication 505 2019 Tax Withholding And Estimated Tax Internal Revenue Service Tax Brackets Federal Income Tax Income Tax Brackets

Expansion Of Child Tax Credit Helped Feed Children In W Va Wvpb

Inflation Ruining Your Budget 3 Clever Ways To Save While Shopping And More In 2022 Child Tax Credit Irs Taxes Tax Refund

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

Irs Warns Of Child Tax Credit Scams Abc News

Tax Season 2022 Tips For A Speedy Refund And How To Avoid Gumming Up The Works The Seattle Times

How To Maximize Paying Taxes With Credit Card Fee For Points In 2022 In 2022 Paying Taxes Credit Card Fees Credit Card

Irs Child Tax Credit Payments Start July 15

Tax Tip Caution Married Filing Joint Taxpayers Need To Combine Advance Child Tax Credit Payment Totals From Irs Letters When Filing Tas

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Irs Urges Parents To Watch For New Form As Tax Season Begins

Refund Status We Apologize Return Processing Has Been Delayed Beyond The Normal Timeframe Tax Topic 152 Mess In 2022 Informative Tax Refund Understanding Yourself

Child Tax Credit 2022 How Much Of Your Ctc Payment Is Expected In Your Refund Marca

What Is Irs Letter 6419 And Why Does It Matter Before You File Taxes Where S My Refund Tax News Information

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

5 Part Series Great Minds Discuss Grinds Scsi Diamonds In 2022 Mindfulness How Are You Feeling Learn A New Skill